The data landscape is expanding. Rapidly.

In 2020, 64.2 zettabytes of data were created or replicated, which is forecast to experience a compound annual growth rate of 23% over 2020-2025, according to the International Data Corporation.

Plus, businesses demonstrating data-savvy behaviour have a ~200% greater market-to-book value than the market average, according to the same source.

Meaning, value-driven, data-enabled businesses represent a valuation premium.

And, in some instances, when data is treated as an asset, it can be worth more than the market value of a company itself.

For example, in 2020, American Airlines secured a multi-billion-dollar loan against its data assets, which were valued between US$ 19.5 to 31.5 bn. Whereas, at the time the stock market valued the entire Group at US$ 5.9 bn.

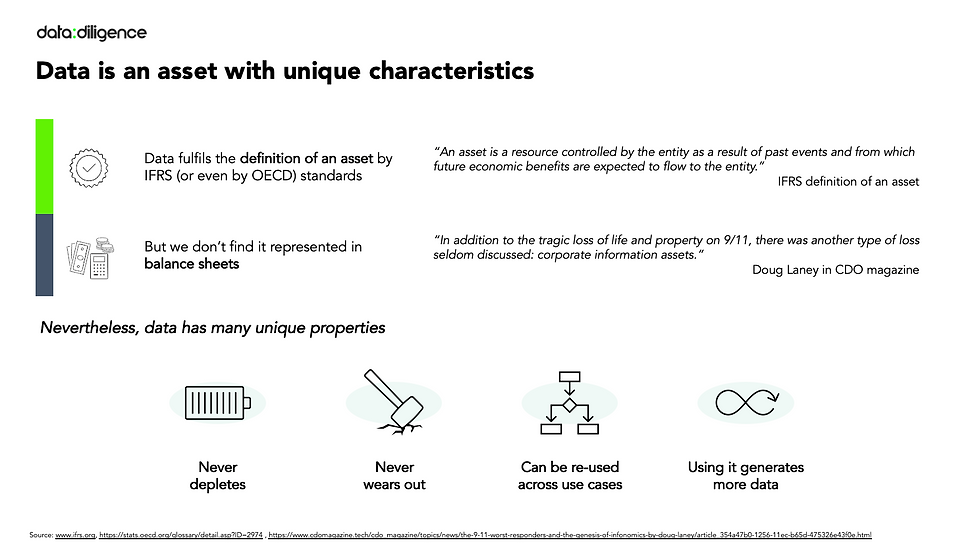

And whilst data is not accounted for on corporate balance sheets, it does fulfil the definition of an asset according to IFRS:

‘an asset is a resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity’.

Rather, due to its unique characteristics, data’s worth can be calculated, based on the economic impact derived from the use cases to which it is applied. Plus, this value can be multiplied over time because data is an asset like no other:

Which is why data's impact (risks & opportunities), plus economic value must to be factored into all M&A investment decisions via a thorough data due diligence.

Comments